With yesterday’s Apple announcement of the iPhone 15 Pro and Pro Max (and I am sooo excited!) I’ve heard a lot of gripes about the switch from a lightning charge cable to a USB-C charge cable. Here’s the deal in a nutshell– and it’s actually a good thing.

Here’s What to Know about Apple’s Switch to USB-C Cables for the iPhone 15 Pro and Pro Max

This post contains affiliate links that may help support our team at no additional cost to you so thank you! All products are independently selected by our editorial team and we stand by our recommendations.

This post contains affiliate links that may help support our team at no additional cost to you so thank you! All products are independently selected by our editorial team and we stand by our recommendations.

The backstory: Replacing charging cables is an old complaint

For years, especially among us Apple aficionados, there’s been a challenge when new iPhones or MacBooks come out and we’re forced to recycle all of the chargers and accessories that are no longer compatible with them. Though to keep us honest, all iPhones and iPads have come with Lightning cables for the past ten years.

Also, charging cables have arguably gotten so much better and more durable over time — even if I still grumble a little about the changes.

Remember the old MagSafe L-shaped magnetic cables for Apple laptops? They never stayed in, and they tended to fray within a year if you were lucky. The USB-C charge cable in my current MacBook Pro is a welcome change.

Why are iPhones changing to USB-C cables? It’s actually a good thing.

You might imagine this is a ploy to make more money off selling new cables and adapters, but not so.

Shown with Belkin’s 30W USB-C Power Adapter

Shown with Belkin’s 30W USB-C Power Adapter

Last year the ministers of the European Union issued a new mandate for one-size-fits-all charging ports. The law is designed to cut down on the reported 11.000 tons of e-waste each year, by making USB-C cables the single standard for your computers, laptops, smartphones, tablets, headphones, video games, game controllers…all of it,

Besides the obvious environmental benefits, do you know how amazing it will be to actually use the same USB-C cable to charge my phone, my AirPods, my kids’ headphones, our tablets, our portable chargers, and our family’s many, many PS4 Dual Shock Controllers?

(There are four teens our home, if that is any indicator.)

If like me, you have ever tried to cram a Lightning Cable into a Micro USB C port, or a squinted to try and figure out the difference between the virtually identical USB Mini A and a USB Mini B ports in a device, you know exactly why I’m so happy about this change.

Is USB-C charging better than Lightning, though?

Yes! Here’s why.

Lightning charging is exclusive to Apple devices, which can be a pain, particularly when you have a multi-platform family. (Or if you’ve ever forgotten a charger at your office, and they don’t have a loaner that’s compatible for your iPhone. Ahem.)

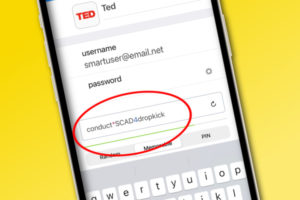

In addition to USB-C standardizing all the charging in your household, it’s so much faster and more powerful. USB-C transfers data at 40 gigabytes per second (Gpbs) or the equivalent of 4,000 Megabytes per second (Mbps). Compare that 4,000 with Lightning’s rate of 480 Mbps and, wow.

USB-C also charges your devices much faster. Using a 20W power adapter, that USB-C should charge your phone to nearly a full battery in about 30 minutes, versus the half-charged battery you’ll get from a Lightning cable in that same time. Big deal when you’re racing out the door and you realize you forgot to charge your phone.

Will you need to get new accessories to support USB-C charging of an iPhone 15 Pro? Yes and no.

There are a few things to know if you plan to upgrade to the iPhone 15 Pro or Pro Max this year–or in the future, as all your new devices become USB-C charged.

- The new iPhone 15 models will not include a power adapter for your outlets, as previous phones have–you will just receive the cable itself. It’s part of their efforts to reach carbon neutrality by 2023.

- If you haven’t upgraded your devices in a while, you may need another basic 20W USB-C power adapter. Though for a little more, I’d recommend Belkin’s durable and super speedy 30W USB-C travel adapter, with prongs that fold down for easy packing whether you’re traveling or just commuting to work.

- If you don’t want to invest in a whole new suite of cables in different lengths, you can also purchase a USB-C to Lightning Adapter. That way you can plug an existing 6′ Lightning Cable (for example) into the adapter, then into your new phone via the USB-C port. I often find my adapters come in handy and I do like having one around whenever charging protocol changes over.

Are there any disadvantages to the USB-C?

Only that your kids will now be more likely to steal your cable for their own devices.

Easy solve: Use a labeling system. We use this affordable Brother P-Touch Label Maker for all the devices in our household of six. Alternately, just use some colorful cable labels, or use colorful wash tape with a different color assigned to each family member.

The benefits of the new iPhone 15 Pro: The highlights

Now that you’re hopefully past any concerns about the USB-C charging, are you considering preordering the new iPhone 15 Pro? Me too!

I am SO ready for an upgrade from my years-old iPhone 12, which works fine…but the photos are so disappointing compared to the magic of my partner’s newer iPhone 15. And the Pro is going to be next level.

Here are some top benefits that families will appreciate.

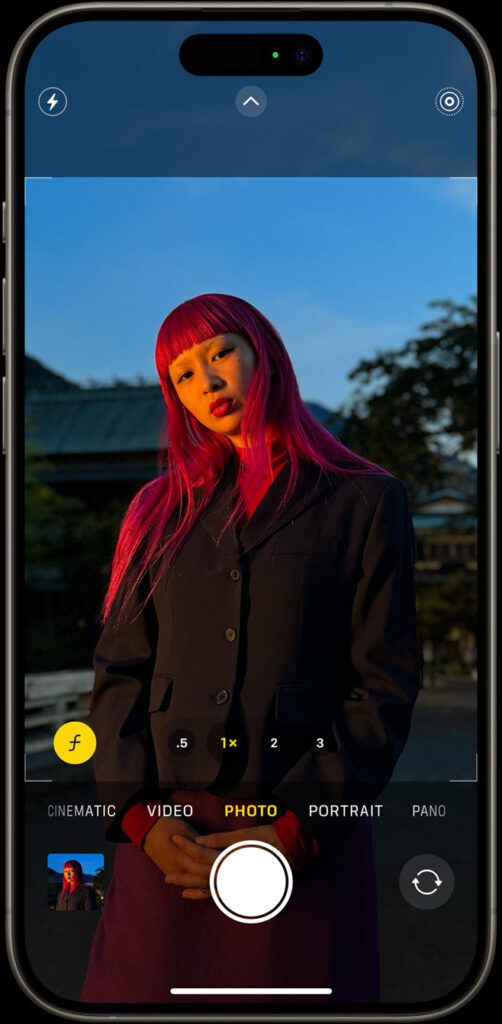

Here’s what 48 megapixels can do in low light. Gorgeous.

Here’s what 48 megapixels can do in low light. Gorgeous.

- A lightweight titanium shell also happens to be dust, water, and splash-resistant, A+++ features for parents.

- The highest video quality of any smartphone is coming to the iPhone 15 Pro. I mean, it even supports the Academy Color Encoding System, the color standard for major movie productions. Pretty sweet for parents who live for all of our family videos.

- Incredible detail in low-light shooting is a big benefit of the 45 megapixel camera. You’ll also get two to four times the resolution of previous models, depending on your settings.

- Get the equivalent of 17 pro lenses, from that 0.5x ultra-wide that the kids like, to a new 2x telephoto, to a sharp 5x telephoto. This is the first iPhone model with a real telephoto lens, and that 10x optical zoom range is more than double what you’ll get with the 4x of the original iPhone 15, and five times the range of the iPhone 14.

- Live Photos will now include aPortrait Mode option, so your most gorgeous photos of wiggly kids will be editable too.

- Wildly speedy, clear graphics for gaming come courtesy of a new A-17 Pro chip and faster graphics processing with a 6-core GPU (Graphics Processing Units). With those graphics now processing 20% faster than before, games will look incredible, no matter what you or your kids play.

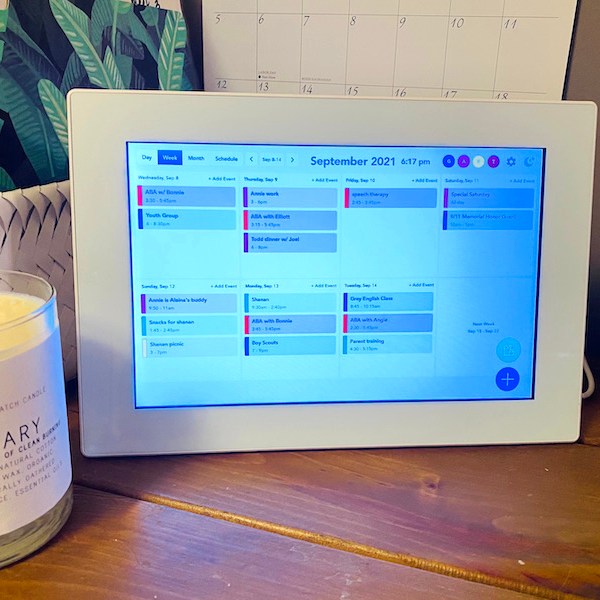

- A new StandBy feature means you can turn the phone on its side in an “always-on” mode, to display widgets, a slide show, or just the time. As someone whose only clocsk in my bedroom are my iPhone and my Apple Watch in a Belkin charging dock on my nightstand, I like this a lot — and really appreciate that while on, the screen will still dim at night

Hey, parents need all the sleep we can get.

- Decent value…if it’s in your budget. The iPhone 15 Pro starts at $999 for 128 gigs of storage, $1099 for 256GB which is fine for most people, up to $1499 for 1 Terabyte if you want to store all the apps, photos, and videos of your wildest dreams.

It’s not cheap by any means, but I think the value is outstanding, especially factoring in the photo and video capabilities. And now that we know the Lightning charge is phasing out, I’d be inclined to spend a little more for the 15Pro if it’s in your budget and get up to speed on the new protocols, versus saving $100 or so on the previous model.