These days, anxiety feels like a constant a companion at my house and I’ve made good use of these meditation apps ever since Covid began. I’m happy to say that when I actually get a chance to use them, they really make a difference.

After all, we’re learning more and more that self-care isn’t about bath salts. It’s about giving yourself real downtime, when and where you need it, so you can reflect, reset, and get back out there again. As parents do.

If you can find a borrowed moment — even if it’s in your closet — definitely give these top meditation apps a try. You just may find what you’ve been looking for.

Related: 16 favorite Hygge gifts for anyone looking for a little more comfort and coziness

7 of the best meditation apps

Updated for 2023

These are 7 of the best meditation apps and mindfulness apps that our team has actually tried and can recommend. By the way — subscriptions make fantastic holiday gifts for someone in need of real self-care. Ask us how we know.

These are 7 of the best meditation apps and mindfulness apps that our team has actually tried and can recommend. By the way — subscriptions make fantastic holiday gifts for someone in need of real self-care. Ask us how we know.

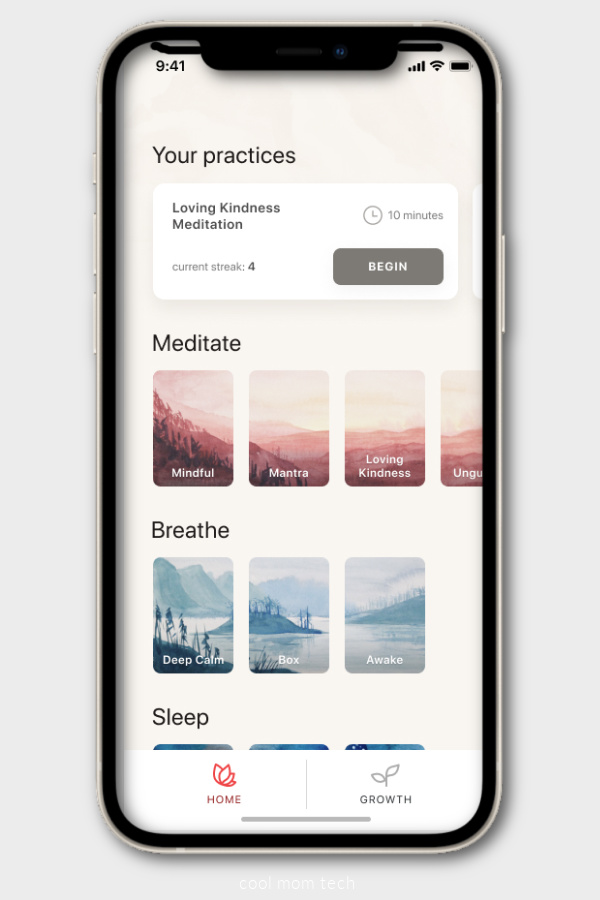

1. Oak Meditation App

1. Oak Meditation App

The Oak Meditation app has been my main squeeze, albeit a rather white-knuckled one, lately. I love how simple it is, and how I’m not constantly bombarded with ads to level up to a paid membership. If you’re a serious meditator looking for lots of content, this may not be for you — although they do offer a multi-day course if you’re willing to pay for it. But for the rest of us, it’s the perfect meditation app for just dipping a toe into guided or un-guided meditations when you need some zen. Also nice to be able to customize the gender of the narrator, length of meditation and more. (Free, with the option to purchase a longer course; iOS only)

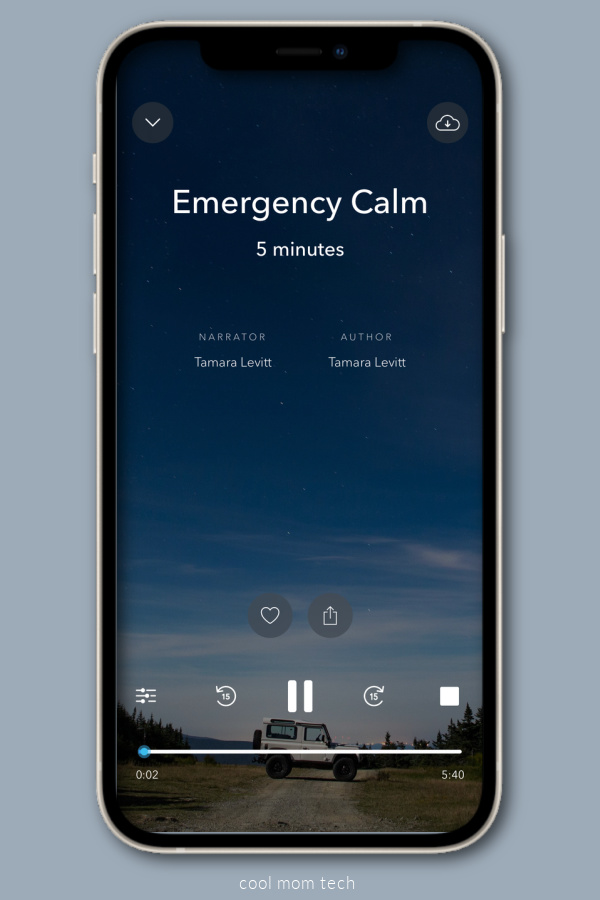

2. Calm App

2. Calm App

After seeing their ads on Instagram, I finally decided to check out Calm. And I’ll say it boasts the sleekest interface of all the apps, and arguably the most variety — and from the most diverse narrators and guides. Calm even reminds you to take a deep breath while it’s loading, which it turns out, I really needed.

Some of the guided meditations are quite specific, like one to help you prepare for a big meeting or the one that helps you calm your anger. One even features LeBron James describing how he mentally prepares himself for big games, and I’m pretty sure it’s going to make me into an NBA all-star if I listen to it enough. But seriously, with so much content to choose from including music, white noise, and of course guided meditations there’s a reason this is so popular.

Also don’t miss the sleep stories — Liz is a huge fan of those to lull her to bed each night. And there’s a brand new family plan thanks to popular demand, which lets up to 6 friends and family members find their own path to calm for one price. (Basic content is free; Premium subscription offers a 7-day free trial, then $69.99/year for full content library, or $99.99/year for the family plan)

Related: The Gospel of Wellness: What if everything we think we know about self-care is wrong?

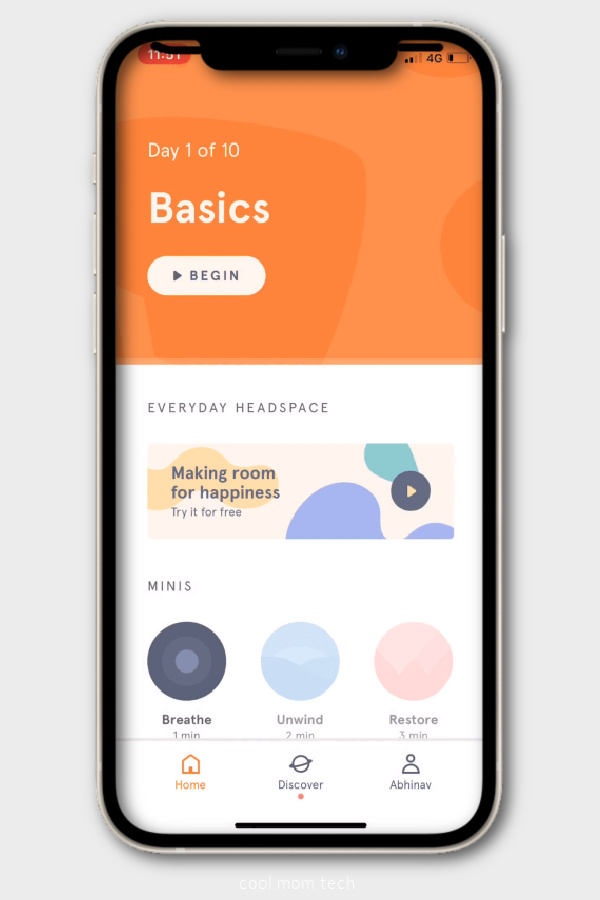

3. Headspace Meditation App

3. Headspace Meditation App

If you’re new to meditation but looking to really commit to a practice, Headspace is a great choice. It starts with a series of short animations that teach basic mindfulness principles, each followed by a guided meditation. If dig the free intro, you have the option of subscribing to the app to get access to a host of guided practices on different topics, including a few designed specifically for kids. (14 day free trial followed by $69.99/year subscription; or try free for 7 days then pay $12.99/mo.)

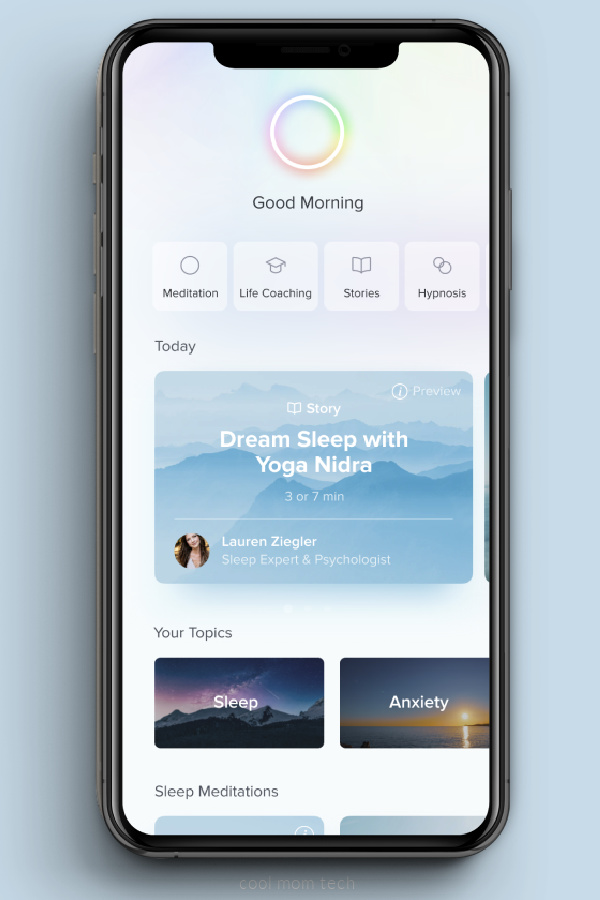

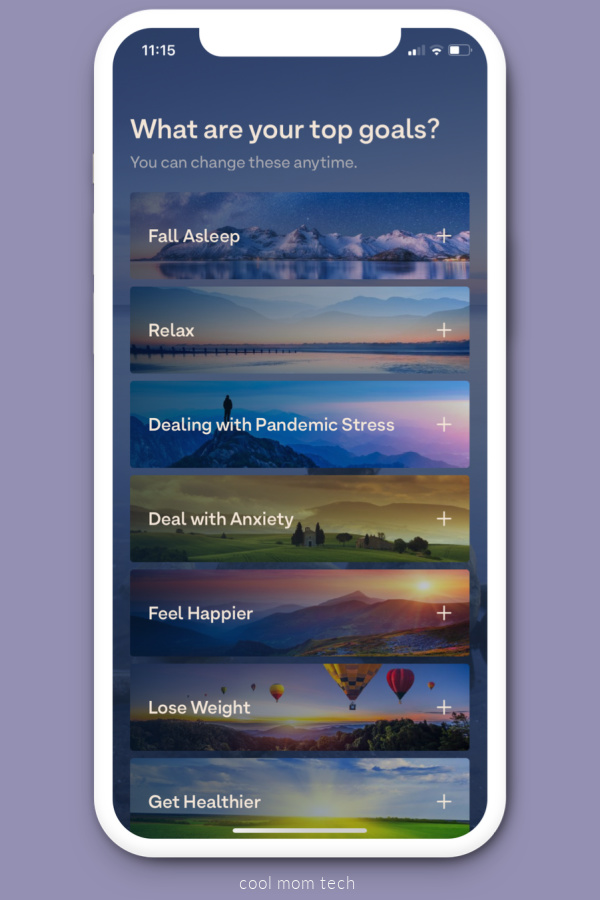

4. Aura Wellness App

The Aura app also requires a subscription to access its best content, but it offers a free trial period so you can decide if you like it. Right off the bat, it asks for your goals and preferences to tailor a plan to say, help you sleep better or manage your emotions. It will then suggest short guided meditations to help you do just that. I loved that I could gear my whole app experience around one desired result — falling asleep faster at night in my case. I’m hoping this app can serve as a healthier alternative to scrolling before bed. (One 3-minute session every 2 hours each day is free; after that, try the annual plan for $59.99/year with a 7-day free trial period, or $11.9//monthly plan. Family plan is $119.99/year for multiple members.)

Related: 7 excellent children’s books about mindfulness.

5. Breethe Meditation App

5. Breethe Meditation App

We all want to de-stress, manage anxiety, and sleep better, and the popular Breathe app promises that in just 5-minute sessions each day. Their goal is to make sure that your goals easily fit into your (already) busy life, and they bring a bit of humor to the process too. As with some of the other apps here, you’ll find a wide variety of meditations, nature sounds, white noise, music, and even hypnotherapy — which we admittedly haven’t yet tried. The thing is, zen doesn’t come cheap — be sure to try it out for the free 14-day trial before forking out the monthly payments. (Free for 14 days, then $12.99/mo)

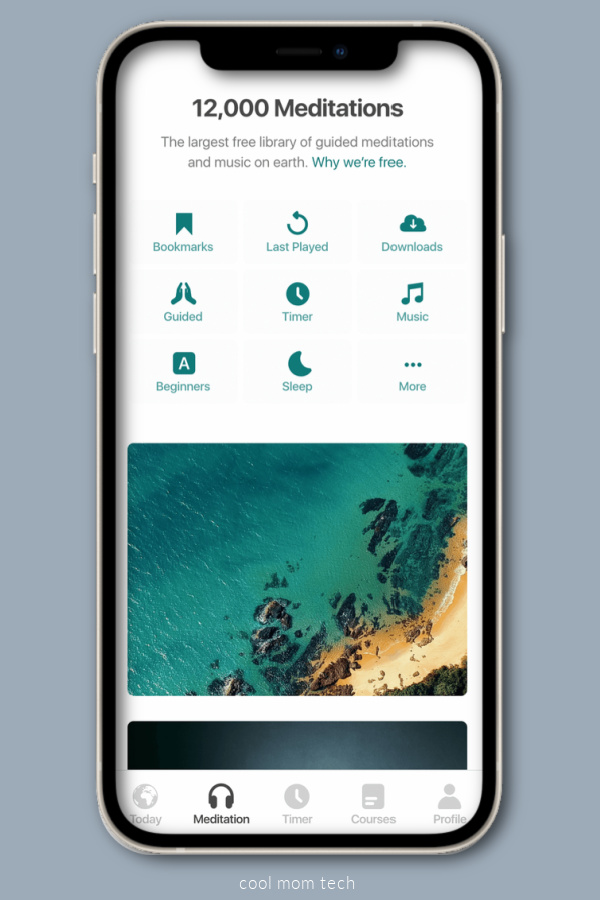

6. Insight Timer App for Stress and Relaxation

6. Insight Timer App for Stress and Relaxation

This app offers an á la carte approach to meditation for those of us who want to skip the intro and zero in on exactly what we’re looking for. A guided meditation to help you sleep? They’ve got that. A five-minute audio file of a waterfall? Yep, got that too. In fact there are over 120,000 meditations to choose from (more than you even see in the screenshot above!) — or you can just set a timer that rings a bell when you’re done with your silent meditation. Basically Insight Timer lets you pick whatever form of meditation chills you out the most, whenever you want it. (Free, with subscription required for advanced content)

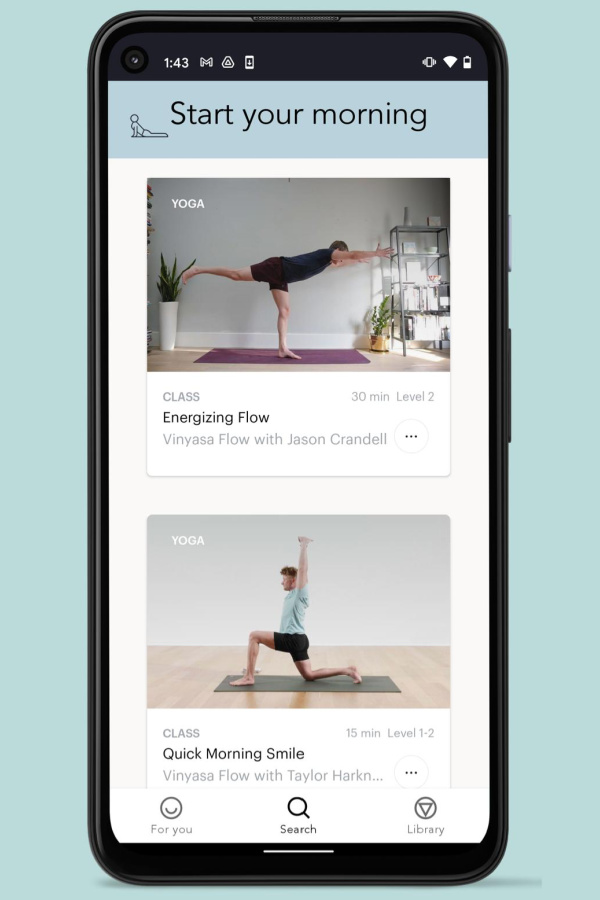

7. YogaGlo App for Meditation, Yoga and More

7. YogaGlo App for Meditation, Yoga and More

If you’re looking to work on your mind-body connection in particular, the YogaGlo app could be for you. It’s more of a workout app/meditation app mash-up, offering guided virtual classes live and on-demand in both areas. Like a few of the other apps, it offers a highly personalized experience based on your desired areas of improvement, including an included 1:1 concierge service “to support your mindful movement practice.”

I love that one of the focuses is postnatal, and that it lets you choose what type of teaching style you prefer, from playful to challenging. Plus, you can integrate it with your health app to track metrics like your heart rate. Yay for measurable progress! Just know it’s not cheap — compare the price to actual yoga classes, not other meditation apps if you want to better justify the expense. (Some free content, but the full library is $23.99/mo or $244.99 annually after a 7-day free trial.)